2022 Northwest Indiana Economic Summary and Outlook

A look at key economic indicators for Northwest Indiana in 2022 with a forecast for the next year.

Note: This is an analysis of data I prepared for the “2023 Economic Outlook” event run by Indiana University that took place at Teibel's a few weeks ago. At the bottom of this page you can find a copy of the handout provided at this event. A more complete article will be published in the Indiana Business Review within the next few weeks.

While there are many things we could look at to assess the economic health of Northwest Indiana Economy, there are two key questions that stand out as having recieved overwhelming attention from Hoosiers over the last few years (and for good reason). They are:

What’s happening to prices (i.e. inflation)?

What’s happening in the labor market (i.e. the ‘Great Reassessment of Work’)?

In this post, I’m going to try and answer these two questions as well as provide some thoughts on how 2023 might look for households and firms.

1. What’s happening to prices (i.e. inflation)?

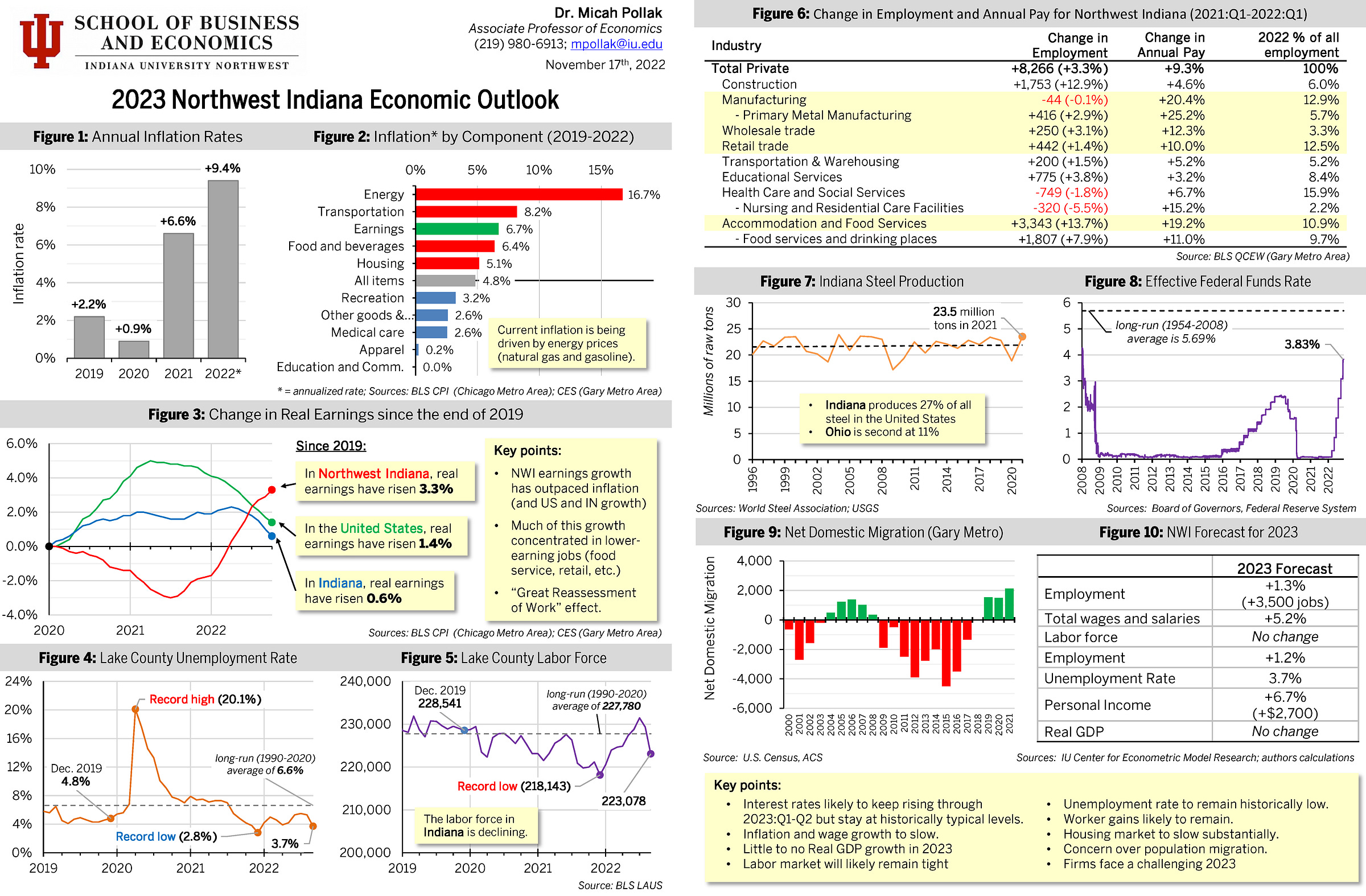

Figure 1 below shows the annual rise in prices (i.e. the inflation rate) for Northwest Indiana in recent years. For the first nine months of 2022, the annualized inflation rate was 9.4%, or almost triple the long-run annualized rate of 3.4% per year (average from 1977 to 2019). Inflation during this year and the last has been much higher than average, mainly due to the economic effects of the Covid pandemic. Despite taking a hit in 2020, consumer confidence returned quickly, driven in part by large Federal stimulus payments during the pandemic, which in turn has driven up aggregate demand. At the same time, supply chain disruptions have reduced aggregate supply for many goods. These effects have combined to drive up the price level rapidly, although more for goods than services.

While inflation has been higher than average in the last two years, during the two prior years (2019 and especially 2020) prices rose significantly slower than typical. During the early years of the pandemic, consumer confidence and spending declined as workers were laid off at record rates and we were faced with so much uncertainty in the future. If we take the entire pandemic period as a whole (from 2019:Q3 to 2022:Q3), the annualized inflation rate was 4.8% per year, which is only somewhat higher than the long-run average.

Over the course of the entire pandemic, inflation in Northwest Indiana was 4.8% per year, or only somewhat higher than the long-run average rate of inflation.

Furthermore, if we dig into the components causing this higher than average inflation, it’s being driven strongly by energy costs. Figure 2 below shows the rise in prices broken out by components of the consumer price index. From 2019:Q1-2022:Q3, energy prices have risen by 16.7% per year on average. While we’ve heard a lot about rising retail gasoline prices, it is really utility (piped) gas service prices that are driving up energy costs the most and have risen a whopping 32.4% per year since 2019. If we exclude energy, then inflation has been 4.0% per year since 2019, which is a higher than typical, but not remarkable.

Lastly, we cannot discuss inflation without also looking at how earning have changed over the same period. Included in Figure 2 is the growth in average annual earnings for Northwest Indiana over the same period (in green). While inflation has averaged 4.8% per year since 2019 (all items in grey), average annual earnings have risen by 6.7% per year, significantly outpacing inflation. Despite the recent high rate of inflation, real earnings have still risen.

Since 2019, average worker earnings have not only kept pace with but have risen faster than inflation. Adjusting for inflation, average earnings in Northwest Indiana are now higher than they were before the pandemic.

Earnings have risen faster than inflation not only in Northwest Indiana, but also for the state and nation. Figure 3 below shows the real earnings relative to the end of 2019. In Northwest Indiana, real earnings are 3.3% higher than before the pandemic compared with 1.4% higher nationally and 0.6% higher for the state of Indiana. Bucking our usual trend, real earnings in Northwest Indiana have risen more (on average) than for the typical worker in Indiana or the United States.

How is it possible that earnings growth in Northwest Indiana has been able to not only keep pace but even exceed inflation? The explanation has to do with the industries which saw the highest earnings growth during the pandemic and the concentration of these industries in Northwest Indiana.

2. What’s happening in the labor market (i.e. the ‘Great Reassessment of Work’)?

If inflation is the most talked about economic topic in recent months, then what’s been happening in the labor market is not far behind. The pandemic has been one of the most tumultuous times for the labor market in recorded history, perhaps only second to the Great Depression and New Deal. The structural changes occurring in the labor market have been called different names, such as the ‘Great Reassessment of Work’ or the ‘Great Resignation’, but whatever name you given them, the term “Great” is appropriate. Figure 4 shows the unemployment rate in Lake County. Within a two-year period, Lake County experienced both the highest (20.1% in Apr. 2020) and lowest (2.8% in Dec. 2021) ever recorded unemployment rates (since the data series began in 1990).

After this period of extreme volatility, the unemployment rate has remained consistently below its typical rate. The long-run average unemployment rate for Lake County (from 1990-2020) is 6.6% and the current (Sept. 2022) unemployment rate is 3.7%, or close to half this long-run rate. While a low unemployment rate is usually desirable, if the unemployment rate remains well below the long-run natural rate of unemployment for an extended period of time, it can result in a tight labor market and strong upwards pressure on wages, which is exactly what we see happening.

One of the reasons the unemployment rate remains so low is because the size of the labor force in Northwest Indiana has been declining and this decline was accelerated by the pandemic. Figure 5 shows the size of the labor force in Lake County over time.

Prior to the pandemic, the labor force was already declining nationally and in Northwest Indiana as part of a demographic shift. We have an aging population with births slowing and retirements rising. For many, the stress associated with work during the pandemic was enough to push them to exit the labor force, often permanently (a full discussion of why so many workers exited the labor force will have to be a topic for another post). In December of 2019, the labor force in Lake County was composed of 228,541 people. Just two years later more than 10,000 people had exited the labor force and it fell to 218,143, or the lowest ever recorded (since 1990). Despite the population of Lake County being 4.8% higher in 2021 than in 1990, there were fewer people in the labor force in 2021 than there were in 1990.

In December 2021, the labor force in Lake County fell to the lowest level in recorded history.

While the labor force has since rebounded some, the current (data for September 2022) size of the labor force in Lake County is still down 2.4% from pre-pandemic levels. As a result of the declining labor force and record low unemployment rate, we are seeing strong upward pressure on wages in Northwest Indiana. This is especially the case in service sector industries where the pandemic triggered significant changes in work environments. Figure 6 below shows changes in employment and annual pay for selected industries in Northwest Indiana over the most recent 12-month period (2021:Q1 to 2022:Q1).

The industries highlighted in Figure 6 have all seen major growth in wages and/or employment. Those in which average annual pay has risen the most include:

Manufacturing: +20.4%.

Primary metal manufacturing: +25.2%.

Wholesale trade: +12.3%

Retail trade: +10.0%

Accommodation and Food Services: +19.2%

While the largest increase in pay has been among manufacturing (and particularly primary metal manufacturing) we have see large increases in pay for industries that are traditionally lower-paying (such as retail and food service). Employment in Northwest Indiana is relatively concentrated in these jobs and thus has disproportionately benefited from the rise in wages for these industries. This is one of the key reasons real earnings have risen in Northwest Indiana faster than for the state and the nation. For Northwest Indiana, these last few years have seen some of the most significant increases in the standard of living and reduction in poverty rates for working class citizens perhaps since the New Deal.

The rise in wages for many low-paying service sector jobs triggered by the pandemic and the “Great Reassessment of Work” has rapidly driven up earnings in Northwest Indiana.

So what does this all mean?

From the perspective of a household or worker, the economic situation in Northwest Indiana has, on average, improved since the start of the pandemic. The labor market is tight, workers (especially skilled and eduacted workers) are a valuable comomditity, and compensation and benefits reflect this. While prices have been rising rapidly, growth in earnings for the average worker has outpaced inflation. As we enter 2023, I think gains made by workers will persist. Even if inflation remains above average for some time, the purchasing power of workers will keep pace. There are, however, some downsides for households. As the Federal Reserve continues to raise interest rates to combat inflation the cost of borrowing will rise. If you’re planning to purchase a house or car with financing in the coming year it will likely be at an interest rate much higher than we have seen in more than a decade (although still at historically low rates).

From the perspective of an employer or firm, the outlook for the coming year is less optimistic. Firms will continue to face raising costs on all fronts. From higher wages and greater bargining power for workers to higher input prices from still shaky supply chains and inflation. To remain competitive, firms will need to find creative ways to do more with less, or mainting the same productivity with fewer workers. As with households, rising interst rates will increase the cost of borrowing, which will make it more expensive for firms to invest and expand.

Handouts from the “2023 Economic Outlook” event

You can download a copy of this handout (PDF) or else view it below:

Hi there and thanks for reading! This comments section down here is a great place for comments or questions. Feel free to post your thoughts!